tax sheltered annuity taxation

SearchStartNow Can Help You Find Multiples Results Within Seconds. A tax-deferred annuity is most advantageous if.

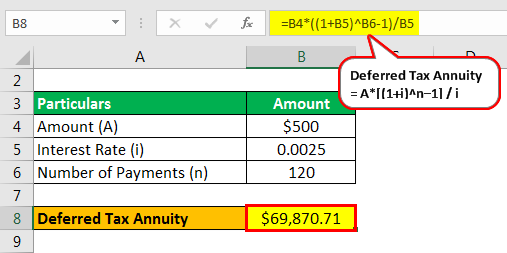

Tax Deferred Annuity Definition Formula Examples With Calculations

If you are a chaplain and your employer doesnt exclude contributions made to your 403 b account from.

. A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities. IRC 403 b Tax-Sheltered Annuity Plans. Ad Learn More about How Annuities Work from Fidelity.

Youre contributing the maximum amount to your other. Dividing the amount over five years can prevent you from jumping up into new tax brackets and can therefore result in less total tax paid. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt.

Thats because no taxes have been paid on that money. So if the annuity buyer paid 10000. A tax-sheltered annuity plan gives employees.

A 403b plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and. That simply means that this lets your investments grow tax-free. Ad Get up To 7 Guaranteed Income with No Market Risk.

Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Ad Learn More about How Annuities Work from Fidelity. As per the publication 571 012019 of the Internal revenue Service IRS the tax authority in the US the Tax-Sheltered Annuity plan is for those employees who work for the specified tax.

Browse Get Results Instantly. Per IRS Publication 571 Tax-Sheltered Annuity Plans 403 b Plans page 4. When you receive payments from a qualified annuity those payments are fully taxable as income.

Ad Annuities are often complex retirement investment products. 20 Years Experience Providing Expert Financial Advice. But annuities purchased with a Roth.

Tax-sheltered annuity example The chief advantage of a TSA is that it can help reduce your taxes. That includes interest capital gains and dividends Once you make a withdrawal or. Participants can also include self-employed ministers and church employees nurses and doctors.

A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt. Ad Search For Info About Tax sheltered annuities. Suzy is a professor of rhetoric at a public university with a 70000 annual salary.

Learn some startling facts. Annuities are tax-deferred. Retirement planning is on your horizon and you are in your 50s or 60s.

A tax-sheltered annuity is an investment that facilitates employees ability to contribute before-tax income into a retirement account. A qualified annuity is an annuity thats purchased using pre-tax dollars through a tax-advantaged account such as a 401k plan or an individual retirement account. The problem with taking a one-time lump sum is that you trigger tax on the entire amount of deferred income that the annuity generated.

A tax-sheltered annuity TSA is a pension plan for employees of. Finally the beneficiary can choose to. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code.

A Tax Sheltered Annuity can also be described as a 403b. TSAs are often offered to employees. Get Free Quote Compare Today.

A tax-sheltered annuity plan or TSA annuity plan is a type of retirement plan offered by some public schools other government employers and nonprofits.

Annuity Basics Ppt Video Online Download

Annuity Taxation How Are Annuities Taxed

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Annuity Lifetime Income Later Safety Guarantees Magi

Taxation Of Annuities Ameriprise Financial

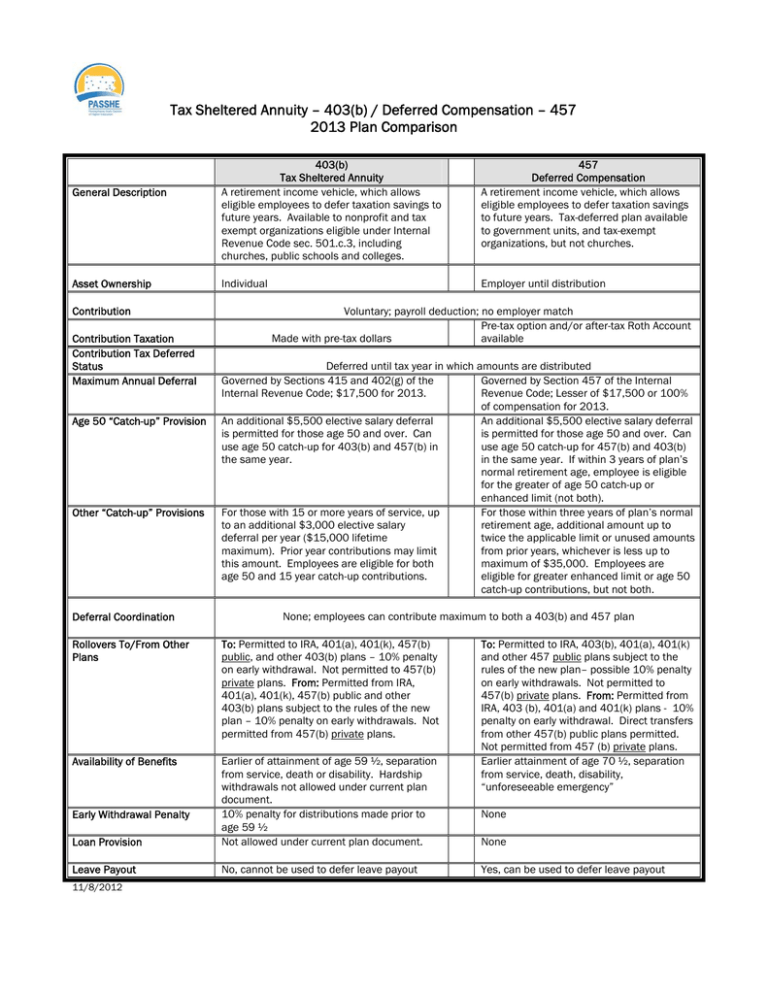

Tax Sheltered Annuity 403 B Deferred Compensation 457

Qualified Vs Non Qualified Annuities Taxation And Distribution

The Tax Sheltered Annuity Tsa 403 B Plan

Annuity Taxation How Various Annuities Are Taxed

5 Ways To Reduce Tax In Retirement Monevator

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

Tax Sheltered Annuity Faqs About Tax Sheltered Annunities Employee Benefits

Tax Deferred Annuity Definition Formula Examples With Calculations

What Are Defined Contribution Retirement Plans Tax Policy Center

Withdrawing Money From An Annuity How To Avoid Penalties

Annuity Taxation How Various Annuities Are Taxed

Solved 1 If A Person Invests In A Tax Sheltered Annuity Chegg Com